U.S. yield curve seems not to contain some relevant macro information, then does it mean inefficiency of the bond market?

After Joslin, Priebsch, and Singleton (2014), many studies found some price-relevant macro information that is hard to be extracted from the U.S. yield curve. It is a little weird because if there is such useful information, investors immediately use the information to make money, so the bond price also immediately moves to reflect that information. Therefore, all information relevant to the bond market should be reflected in the yield curve (and bond prices). In other words, the existence of information that is not spanned by the yield curve (we call it “unspanned” information or risk) is a puzzle in bond pricing literature.

The easiest way to understand the puzzle is by arguing the inefficiency of the bond market (or investors). Yeah, the bond market may be inefficient and investors are not always rational. From this perspective, Cieslak (2018)’s finding is notable. He argues that investors’ systematic forecasting errors for the monetary policy create unspanned information that has ex-post predictability. Therefore, according to this paper, investors cannot utilize this unspanned information.

On the other hand, if you do not want to abandon FIRE (full-information rational expectation) assumption, there is also an existing way to explain it. Some people (Duffee, 2011; Cieslak and Povala, 2015; Bauer and Rudebusch, 2017) argue that all information is in the yield curve, but measurement errors prevent us from extracting some information, so it seems as if the information does not exist in the yield curve.

In this post, I want to raise another explanation briefly using the working paper that was jointly written by Kyu Ho Kang and me. The main topic of our paper is the time-varying influence of unspanned macro risks on future yields.

According to our estimation result, bond investors do not reflect some current real activity information in current yields. Instead, they reflect it in the short end of the future yield curve if the future economic regime is realized as a recession. However, if the future regime is an expansion, the medium and the long end of the future yield curve absorb the unspanned information.

In our paper, we rephrase the regime-dependent behavior of investors as follows: When real activity information occurs, investors do not fully reflect the information in bond prices and wait until the next period regime realizes. If the future regime is an expansion, investors use the information to adjust their mid-term expected monetary policy. However, if the regime is realized as a recession, they change their expectation for near-term monetary policy based on unspanned information. If you remind that central banks usually rapidly respond to real activity fluctuations in recession than in expansion, we can rationalize the regime-dependent behavior of investors. In addition, we find that bond investors move their funds to more risky assets if there is a positive real shock and the future regime is an expansion. This is because the situation decreases investors’ risk aversion. It affects the term premium and the level of the future yield curve.

In summary, investors want to act differently depending on the future economic situation, so they wait until the future regime is realized. After they observe the future regime, they reflect the remaining unspanned information in the different parts of the yield curve depending on the realized regime. This is our explanation for the existence of unspanned macro information. Our explanation is valuable because we do not assume the irrationality of investors.

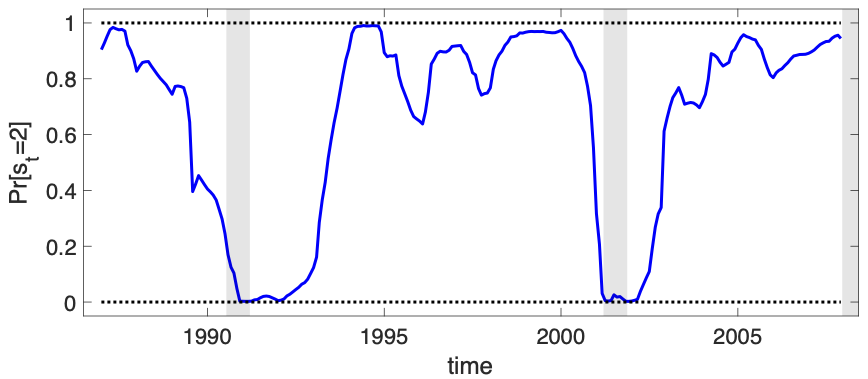

Figure 1. Estimated Regime Dynamics from Our Paper

Figure 1 shows where the unspanned information is reflected in. The y-axis in the graph represents the posterior probability of the regime being in state two in each period. “1 - the probability” is the posterior probability of the regime being in state one.

Regime 1 is the time when the unspanned information is reflected in the near-term expected monetary policy (or the short end of the yield curve). Regime 2 is the period when the unspanned information is reflected in the medium-term expected policy rate and term premiums (so the medium to the long end part of the yield curve). You can see that regime states one and two are related to the recessions and expansions, respectively.

References

- Bauer, M. D. and Rudebusch, G. D. (2017), “Resolving the spanning puzzle in macrofinance term structure models,” Review of Finance, 21, 511–553, publisher: Oxford University Press.

- Cieslak, A. and Povala, P. (2015), “Expected returns in Treasury bonds,” The Review of Financial Studies, 28, 2859–2901.

- Cieslak, A. (2018), “Short-Rate Expectations and Unexpected Returns in Treasury Bonds,” Review of Financial Studies, Oxford Academic, 31, 3265–3306. https://doi.org/10.1093/RFS/HHY051.

- Duffee, G. R. (2011), “Information in (and not in) the term structure,” The Review of Financial Studies, 24, 2895–2934.

- Joslin, S., Priebsch, M., and Singleton, K. J. (2014), “Risk premiums in dynamic term structure models with unspanned macro risks,” Journal of Finance, 69, 1197–1233. https://doi.org/10.1111/jofi.12131.