Unveiling the Intersection between Global Inflation and the Global Yield Curve; Are They Separate Phenomena?

Many papers, including Ciccarelli and Mojon (2010), have found that global inflation drives domestic inflation internationally. On the other hand, Diebold, Li, and Yue (2008) define and estimate the global yield curve, which represents the comovement of domestic bond yields. In fact, verifying the existence of these global factors is straightforward. Lee and Kang (2023) conducted a PCA analysis on the inflation and interest rates of 30 OECD countries. They found that 77.9%, 82.5%, and 53.3% of the total variations in long-term yields, short-term yields, and inflation are explained by the corresponding first principal components, respectively.

What caught our attention is that existing literature has not explored the relationship between global inflation and the global yield curve—a relationship especially evident when considering the Fisher equation.

$i_{t} = r_{t} + \pi_{t}$, where $i_{t}$ and $r_{t}$ are nominal and real interest rates at time $t$ and $\pi_t$ is inflation at time $t$.

How can the comovement of $\pi_{t}$ be irrelevant to the comovement of $i_{t}$? We believe global inflation should be examined alongside the global yield curve or vice versa. Our working paper, mentioned earlier, employs a high-dimensional empirical model that incorporates both global comovements and then estimates it to dissect the essence of these two comovement phenomena.

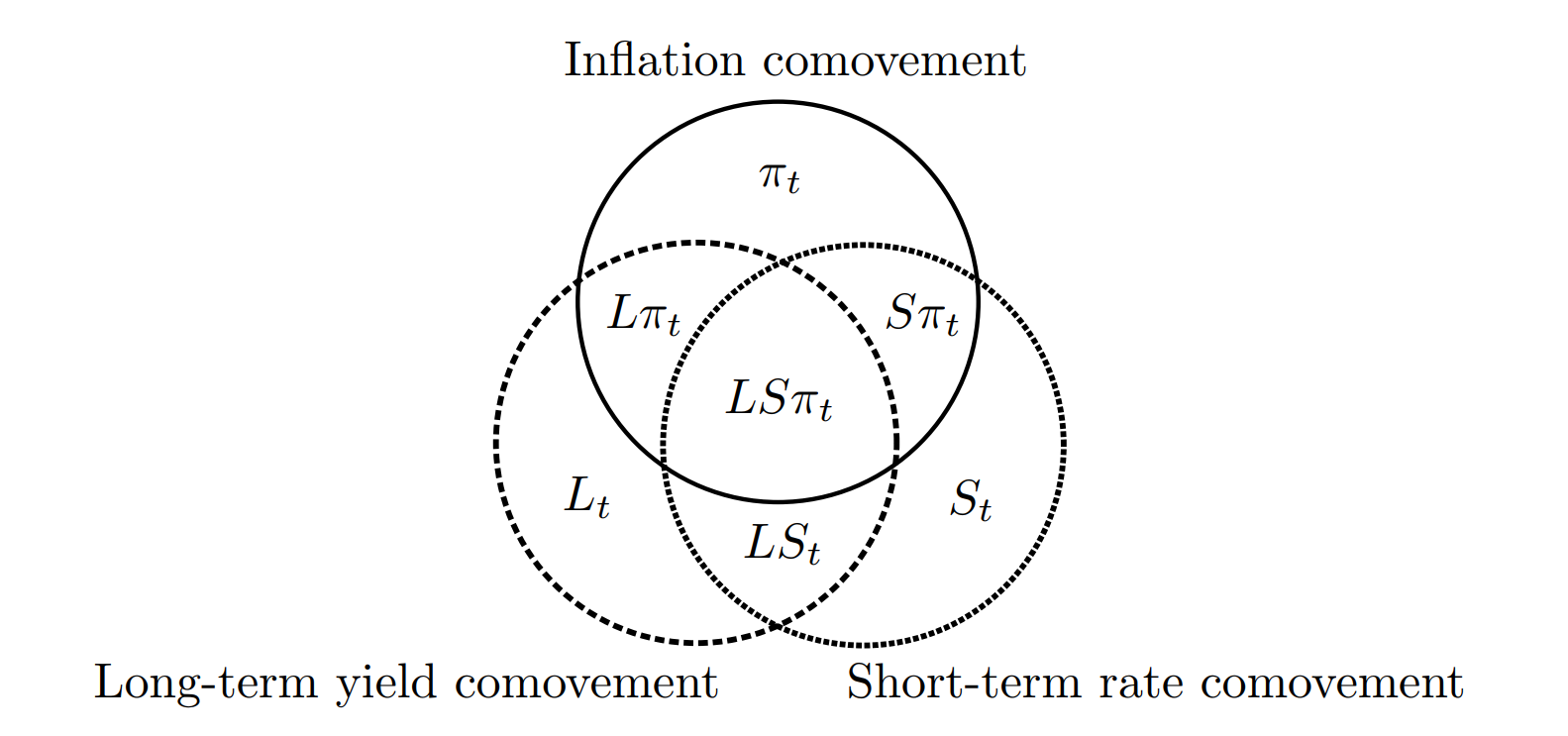

Figure 1. Our Common Factor Model

Figure 1 summarizes our empirical high-dimensional model. Our data comprises 90 dependent variables: each of the 30 OECD countries has three domestic variables—long-term yield, short-term yield, and inflation. Using a standard common factor model, we reduce the dimensionality from 90 dependent variables to 7 common factors. The figure defines the seven common factors. For example, $S\pi_{t}$ is a common factor for domestic short-term yields and domestic inflations but is not shared by domestic long-term yields. Our key factors are $LS\pi_{t}$, $L\pi_{t}$, and $S\pi_{t}$ because they influence domestic inflations and domestic yields simultaneously.

According to our estimation results, all key factors exist both quantitatively and qualitatively. Additionally, we interpret the key factors using a DSGE model by Galí and Monacelli (2005) as follows:

- $LS\pi_{t}$: expected global real activity

- $L\pi_{t}$: long-term expectation for non-commodity global inflation

- $S\pi_{t}$: short-term expectation for non-commodity global inflation

- “non-commodity global inflation” refers to global inflation orthogonal to the global commodity price index.

We further discovered the relationship between non-commodity global inflation and global liquidity. Therefore, our main conclusion is that global real activity and global liquidity represent the intersection between global inflation and the global yield curve.

Our findings say that increases in global real activity or global liquidity lead to rises in global inflation and the global yield curve that are detrimental to bond investors. So, global real activity and global liquidity are risk factors for globally diversified bond portfolios. The most dominant common factor for long-term yields is $L\pi_{t}$. This suggests that fluctuations in global liquidity can create significant uncertainties for global portfolios, and investors should exercise caution when global liquidity is dominant.

$L\pi_{t}$, related to the long-term expectation for global liquidity, is also important for central bankers. When global liquidity is expected to increase in the long run, global inflation and global long-term yield rise due to the forward-looking behavior of inflation and increased compensation for long-run inflation (it is also our findings). Therefore, central bankers could face a frustrating situation when global liquidity is expected to persistently rise during a recession: they would have to deal with a recession under deteriorating financial conditions and increased price levels. Global liquidity is exogenous to many central banks, so cooperation and communication between them are crucial for controlling global liquidity appropriately and averting such unfavorable scenarios.

References

- Ciccarelli, M., and Mojon, B. (2010), “Global Inflation,” Review of Economics and Statistics, 92, 524–535. https://doi.org/10.2139/ssrn.1335348.

- Diebold, F. X., Li, C., and Yue, V. Z. (2008), “Global yield curve dynamics and interactions: A dynamic Nelson-Siegel approach,” Journal of Econometrics, Elsevier B.V., 146, 351–363. https://doi.org/10.1016/j.jeconom.2008.08.017.

- Galí, J., and Monacelli, T. (2005), “Monetary policy and exchange rate volatility in a small open economy,” The Review of Economic Studies, 72, 707–734. https://doi.org/10.1111/j.1467-937X.2005.00349.x.